What’s in store for the fertilizer sector next year? We are sharing a part of the big strategy of BCS analysts for the Russian market – let’s see how things will be in the industry as a whole, and which securities will be the favorites.

Phosphate fertilizers are not yet affected by sanctions

Fundamental characteristics of the phosphate fertilizer market remain stable. Fertilizer prices have declined from highs in Q1-2 2022, but remain above multi-year averages. In terms of volume, exports (and production) of phosphate fertilizers were unaffected.

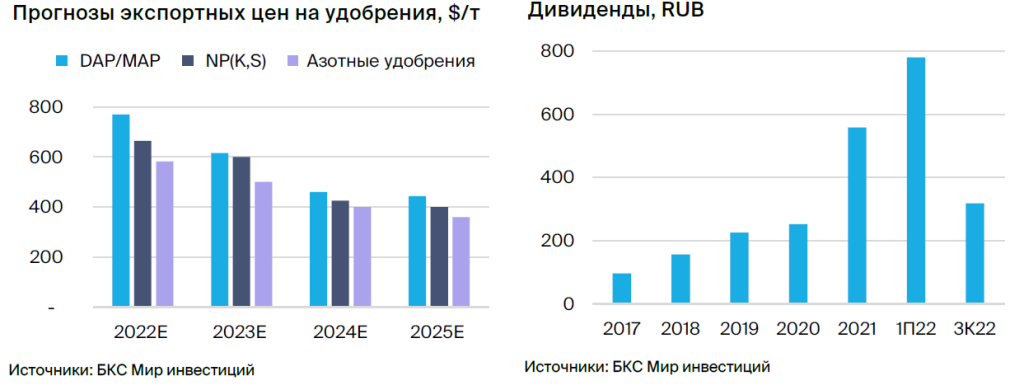

The export duty (which will probably apply from 2023) is set at a quite reasonable rate of 23.5%, and will only be charged on prices above $450 per ton. The current price level is above this threshold, but the duty is unlikely to be too high . The key factor to take into account is the gradual decline in the price – in our opinion, the fertilizer market is reducing the geopolitical risk premium.

Another important issue is the preservation of export volumes, while we do not exclude other negative factors (sanctions, blocking or other violations of export deliveries).

PhosAgro

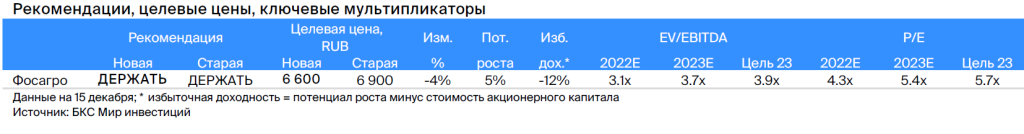

We reiterate our HOLD recommendation for PhosAgro shares and lower our target price to RUB 6,600 from RUB 6,900. Updated exchange rate forecasts slightly lower our estimate.

Company view

PhosAgro’s business case is largely determined by prices. Since prices are declining from the records of the first half of 2022 (according to the company, according to the MAP they were traded at $777 per ton FOB Baltic Sea in the third quarter of 2022 and at $1,009 per ton in the first half of 2022).

We maintain a neutral view of the company, but note good corporate governance. In addition, the company shares high profits with shareholders. At the same time, no one canceled the fundamental factors, so if (and when) prices fall, there will be less profit to be distributed.

growth drivers

• No price cuts in 2023. We now forecast MAP/DAP prices to fall 21% yoy in 2023 and 25% yoy in 2024. If prices remain at current levels, we can expect profit growth, dividends and hence valuation.

• Weaker ruble could support ruble profits (for exporters). According to our estimates, the ruble exchange rate in 2023 will not actually change compared to 2022 (68.4 rubles per dollar and 68.5 rubles per dollar).

Given the significant volume of exports in total revenue, PhosAgro’s valuation is quite sensitive to the exchange rate. The weakening of the ruble will have a positive impact on our ruble valuation.

Key risks

• Disruptions in export supplies could destabilize markets. The risk of sanctions at this stage is rather hypothetical, but given the various restrictions on Russian fertilizers (quotas, etc.), this cannot be completely ruled out. As an exporter, PhosAgro is sensitive to USD/RUB exchange rate fluctuations.

Prices for PhosAgro’s main products, although they have declined, are still quite high. The risk to our valuation is related to the rise in fertilizer prices, the weakening of the ruble and the persistence of elevated prices for a long time.

Major changes

Currency fluctuations, administrative expenses. We have revised SG&A growth in 1H22 (+131% YoY) and normalization in 3Q2022 (only +2% YoY).

We now believe that this jump was a one-off due to payments to retired members of the board of directors. In part, this effect offset the increase in ruble exchange rates. The forecast for 2022 will be slightly worse than we previously forecast, and the EBITDA guidance for 2023 is also slightly lower. In 2024, the reduction in administrative expenses will fully offset the effect of the currency revaluation and EBITDA/earnings will improve.

Evaluation and recommendation

Slightly reduce the target price, confirm “Hold”. To estimate PhosAgro, we use the DCF model with a WACC of 16.4%, a CoE of 16.7% and a post-forecast growth rate of 3%.

Our model shows a target price for 12 months of 6,600 rubles. — “Hold” (taking into account our forecasts of prices and volumes). Obviously, our valuation is also sensitive to export prices (about 70% of sales), supply capacity, volumes, exchange rates, etc. Note that volumes and prices are of the greatest importance for a company’s exports.